| EVERYTHING SOLAR

| ABC Solar Incorporated 1000 Veterans Blvd, Suite 301 Metairie, LA 70005 CL.75218 PH: 1-504-265-1201 E: NOLA@ABCsolar.com Mel Leveque, General Manager |

Mel Leveque - General Manager

Mel Leveque - General ManagerDiscover the Power of the ABC Solar Safe House!Hello, I'm Mel Leveque, General Manager at ABC Solar NOLA. If you're tired of power outages and want a reliable, sustainable solution, let me introduce you to the ABC Solar Safe House. With our advanced solar and battery backup systems, you’ll never have to worry about being left in the dark again. Government Pays Up to 60%! The ABC Solar Safe House Advantage:

Special Benefits for Non-Profits, Schools, and Government Entities:Non-profit organizations, schools, and government entities can benefit from the Federal Tax Credit up to 70%, offered as a grant! This means substantial savings and an excellent opportunity to invest in renewable energy. How It Works:

Join the Solar Revolution Today! Visit our website at www.ABCsolar.com/NOLA for more details and to learn how we can help you protect your home and save money. Contact Us Today!Phone: 504-265-1201 Email: NOLA@ABCsolar.com ABC Solar NOLA What Direction is Best

Sing this:

South is best

Send us your electric bill at Solar@ABCsolar.com and ask for a free solar evaluation. Cut The Cord

1. Solar Pool Pumping - Learn more at SolarPoolMan.com

|

| |||||||||||||||||||||||||||||||||||||||||||||||

|

*If you have a unique roof ABC Solar is your team.

|

|

Battery Systems

ABC Solar Storage / Battery System Choices

ABC Solar Storage / Battery System Choices

PumpDaily.com - Solar Battery Water Pumping Applications

Call or email to talk about batteries on 1-504-265-1201

Daily Breeze Reader Award

ABC Solar Wins Best Solar Company in the South Bay 2021

ABC Solar Wins Best Solar Company in the South Bay 2021

This is a great honor for ABC Solar

as readers voted on their own to name our team

the best Solar Company in the South Bay.

Call us today at 1-504-265-1201 and ask for Mel.

Visit ABC Solar Headquarters at www.ABCsolar.com.

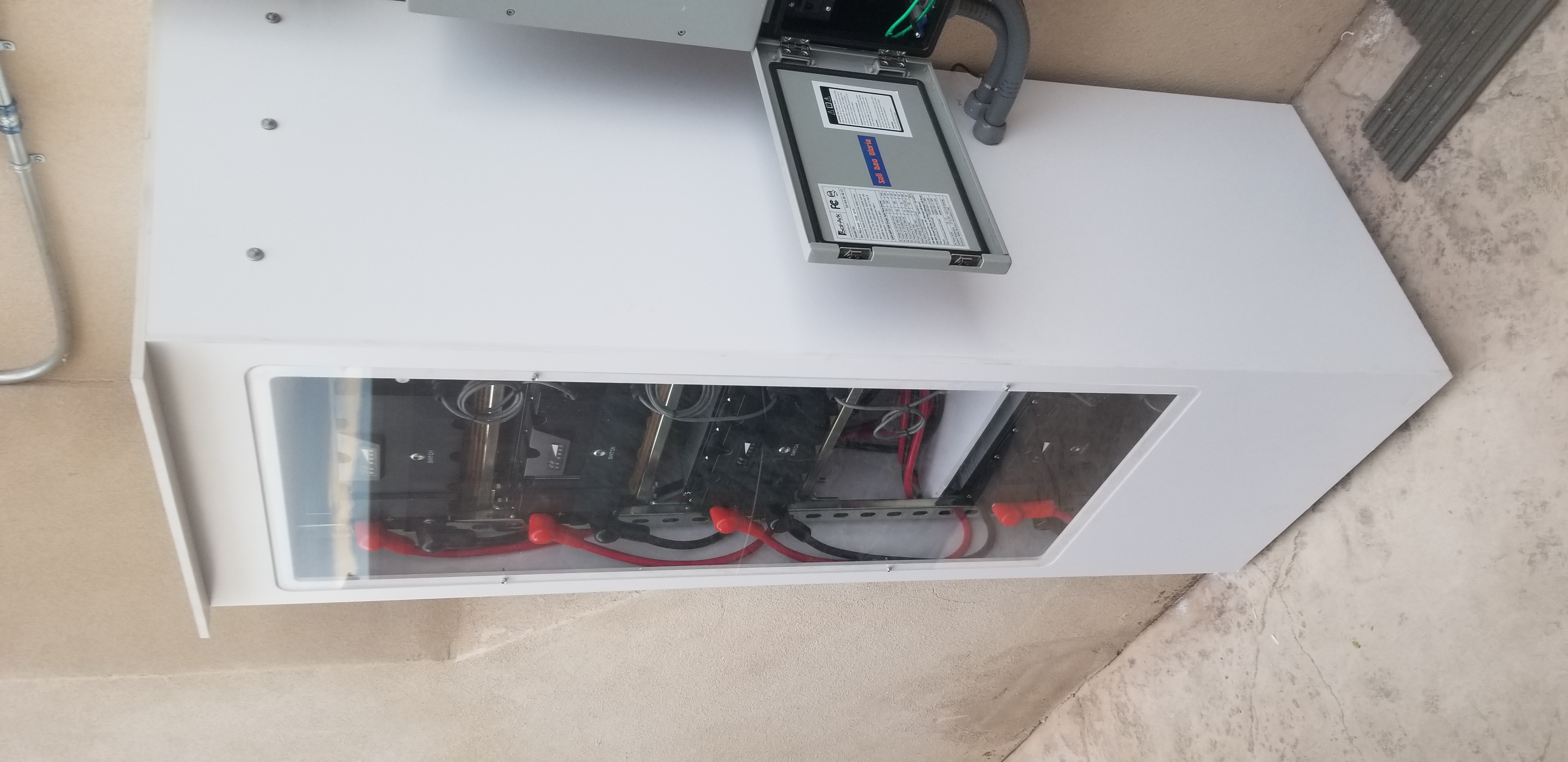

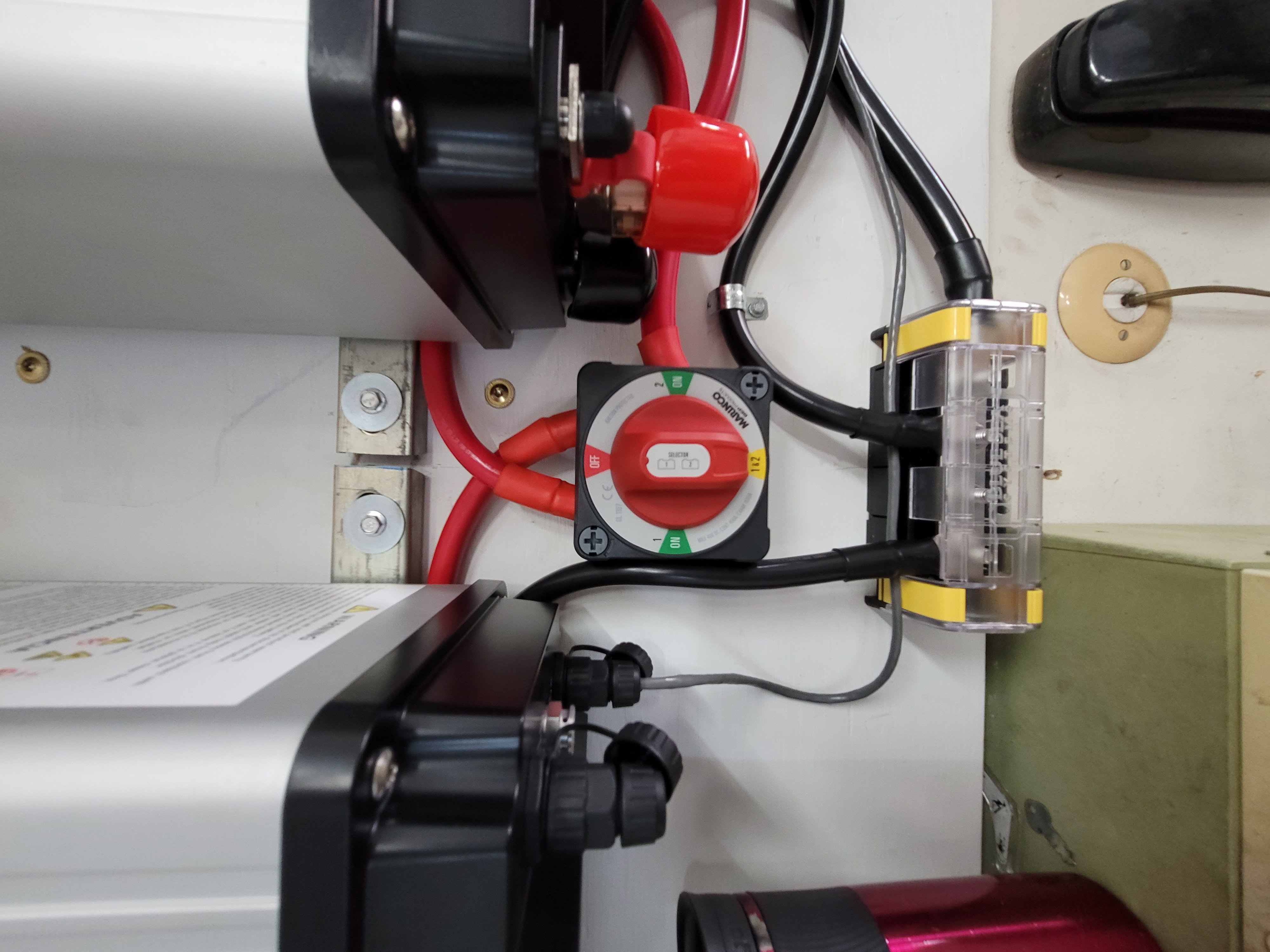

Mike Bartz commissioning an ABC Solar Advanced Storage System featuring the Sol-Ark hybrid battery inverter and batteries from Fortress Power. Indoors or Outdoors the ABC Solar team will install a tight and right system.

Mike Bartz commissioning an ABC Solar Advanced Storage System featuring the Sol-Ark hybrid battery inverter and batteries from Fortress Power. Indoors or Outdoors the ABC Solar team will install a tight and right system.